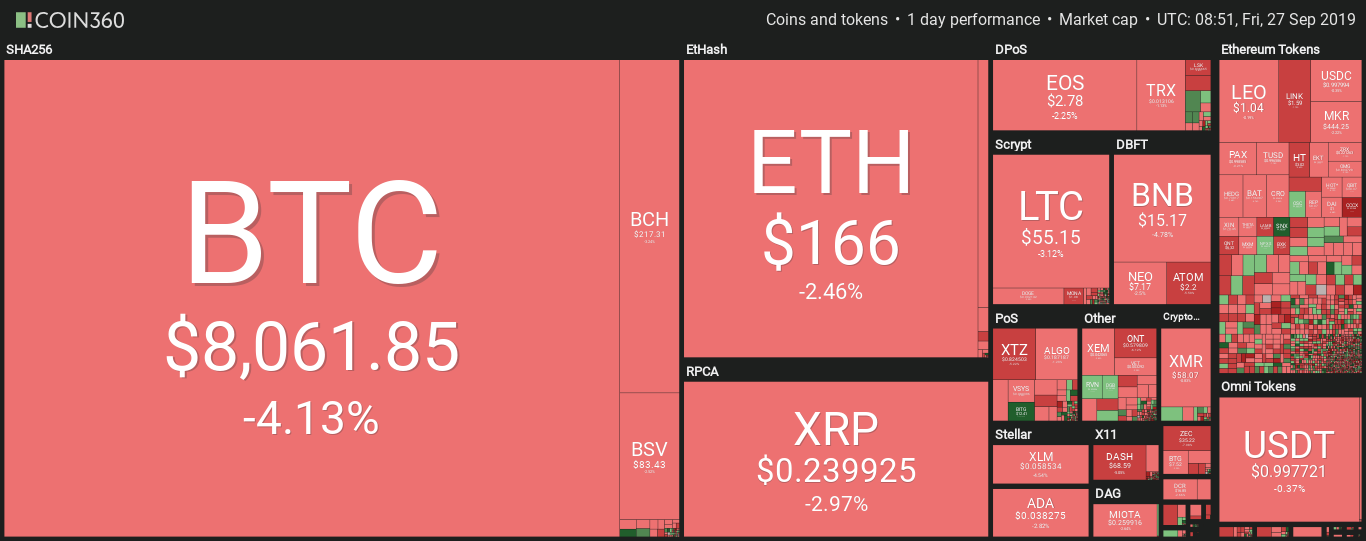

Bitcoin (BTC) price dropped out of the descending triangle, causing a level of extreme fear to spread throughout the entire crypto market.

Bitcoin price remains bearish since the top at $13,800, as the price has been trending downwards in a channel. However, is the price of Bitcoin bearish overall or only short term?

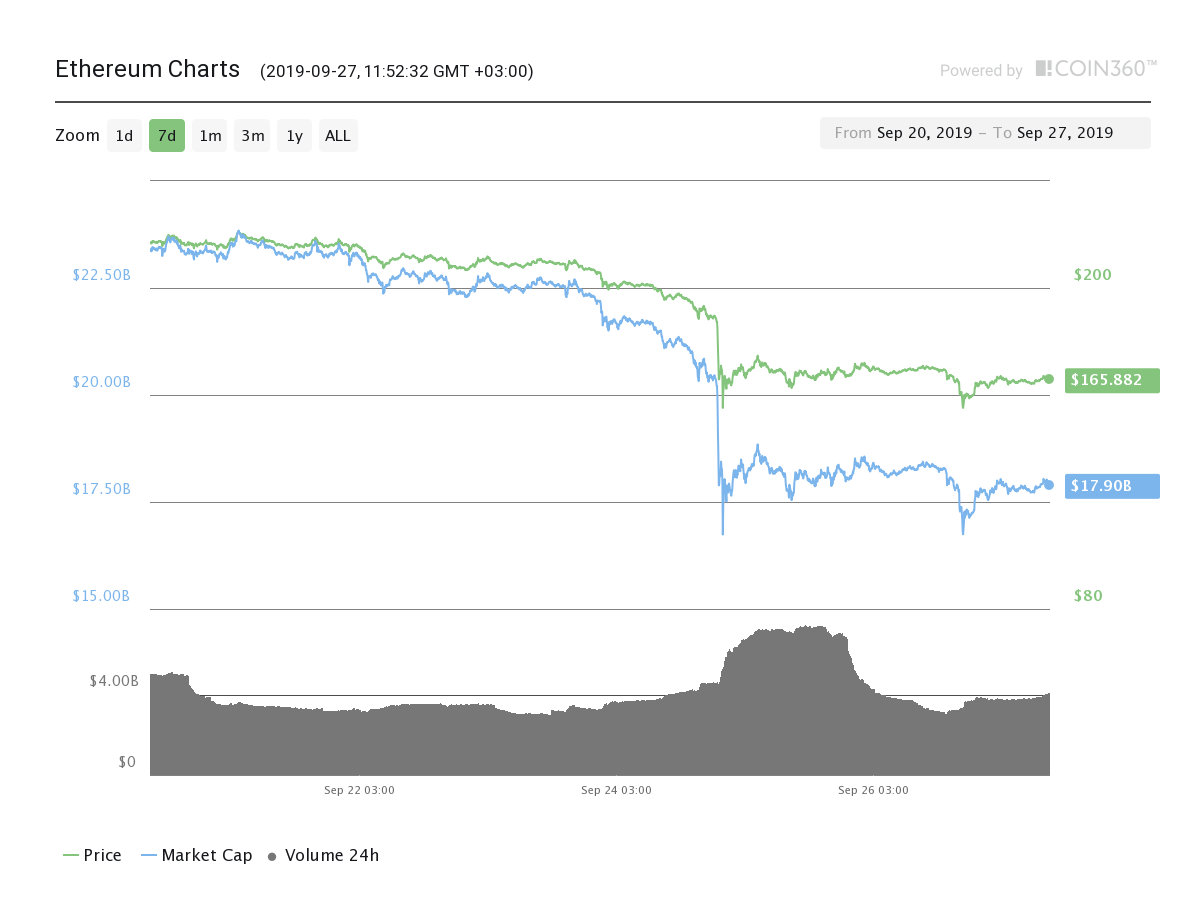

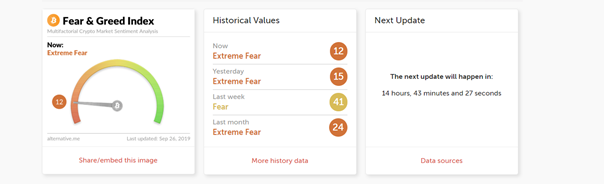

Crypto market sentiment registers extreme fear

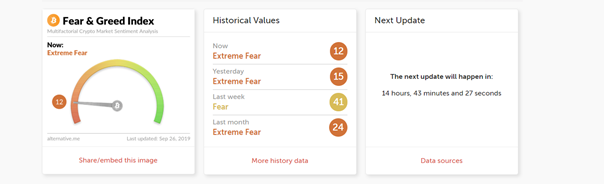

Crypto Fear & Greed Index. Source: Alternative.me

The Crypto Fear & Greed Index currently shows that there is extreme fear in the market. The index is based on volatility (25%), market momentum/volume (25%), social media (15%), surveys (15%), dominance (10%) and trends (10%).

Generally, the index is a good indicator to use in technical analysis as it describes the general sentiment. Currently, the sentiment is extreme fear with a number of 12 out of 100. These numbers were only seen during the bearish period from December 2018 – February 2019 and during the sudden price drop in the middle of August this year.

As once said by Baron Rothschild: “Buy when there’s blood on the streets, even if the blood is your own,” adds value to this indicator.

When markets are in extreme fear, this will provide purchasing opportunities and when markets are euphoric or greedy (e.g. your local Uber driver starts a conversation about Bitcoin), it’s time to get out.

What is important to focus on now is whether this fear is justified or if the macrostructure still trends upwards?

Macroview view of Bitcoin

BTC/USD 1-week chart. Source: Tradingview

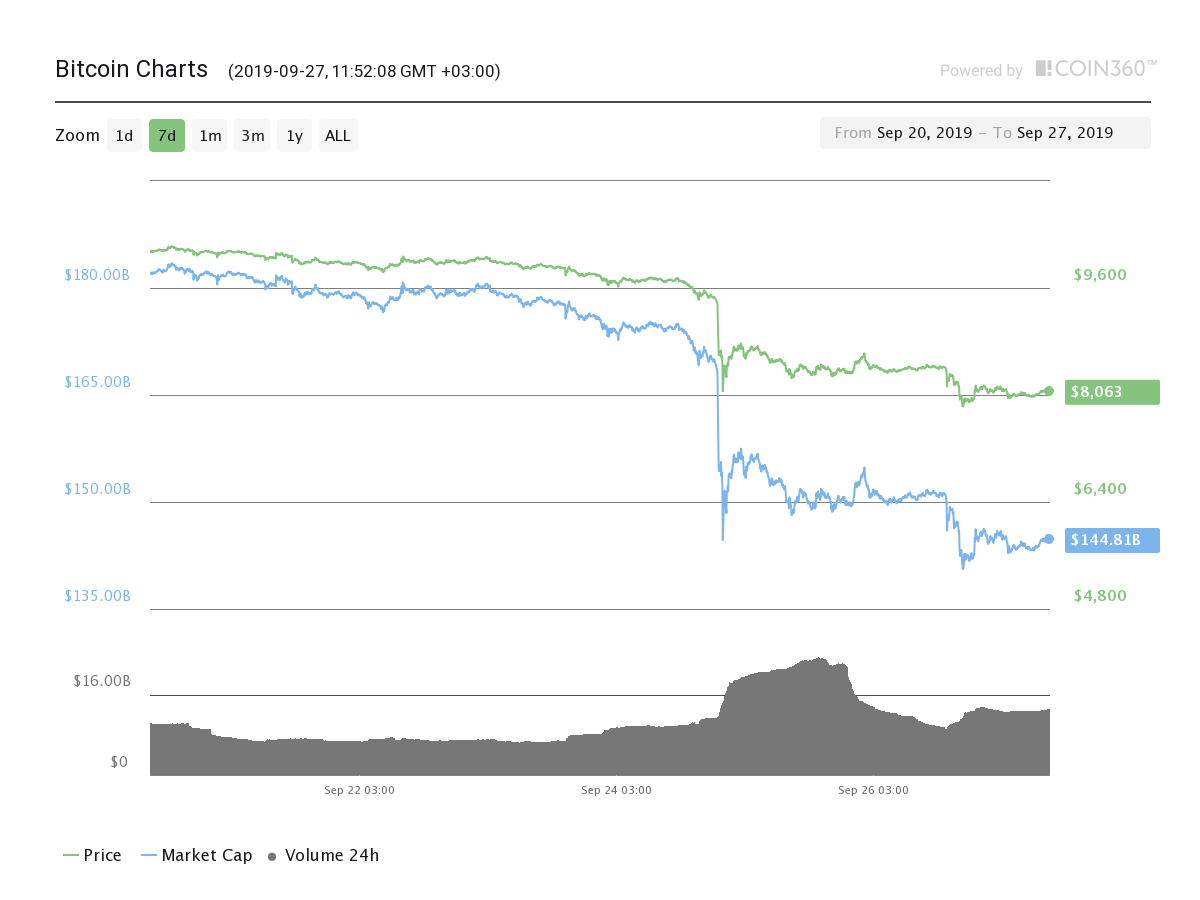

Bitcoin broke down from the descending triangle and could not hold the 21-Week Exponential Moving Average (WMA), causing the price to drop back down towards the next support zone around $8,000.

Losing the 21 WMA led to a retest of the next crucial level at the 100-Week Moving Average (WMA) In previous market cycles, the 100-WMA was tested before a significant uptrend started. Currently, the 100-WMA is hovering around $7,800 and still beneath the current price.

From the macro perspective, one could conclude that the market is still trending upwards as the 2018 bottom was $3,400.

A bird’s eye view of Bitcoin

BTC/USD 1-day chart. Source: Tradingview

As Bitcoin dropped below the support of $9,300-9,400, a significant chain reaction caused the price to rapidly drop immediately towards $8,000 (green zone). This drop is significant for a number of reasons.

One of them is the completion of the 3-month-old descending wedge. The drop below $9,300 completed the triangle play and indicated the direction Bitcoin would take.

The first reaction is that people start panic selling their Bitcoin due to the loss of crucial support. Another reason is the immense amount of stop/loss orders placed beneath the important support. Once triggered this caused the market to drop due to the high amount of sell volume.

Bitcoin then fell through the soft support at $8,800 as the high amount of sell volume pressed the price to $8,500. From there on, the next support level is the level the price is resting on right now, the horizontal area around $7,800-8,000 and the 100-Week MA.

The VPVR (Volume Profile Visible Range) indicator shows where high volume levels of support and resistance and the next big orders are placed. This indicator can provide great information during drawdowns as it shows the next level of support.

Right now the indicator is giving information that the price is resting on a significant block of orders. Breaking upwards could lead towards the next “bigger” block around $9,400-$9,800.

Bearish scenario

BTC/USD Daily Chart. Source: Tradingview

Bitcoin is clearly in a downtrend and the bearish scenario is pretty straightforward. Losing the 100-WMA and losing this support block would lead towards the next area of support located around $7,300-$7,600.

Essentially, if the market is able to break upwards with a weak volume bounce, the price could still make another significant drop which could be interpreted as a bearish retest of $8,800.

It’s key to watch the movements in the coming hours/days and the strength of them, as they can tell a lot about the direction of the market short term.

Ultimately, losing the trend here (the whole channel) would be extremely bad for Bitcoin in general.

Bullish scenario

BTC/USD Daily Chart. Source: Tradingview

BTC/USD Daily Chart. Source: Tradingview

In the short term, it’s preferable that Bitcoin remain within the horizontal area and 100-WMA before moving upwards to the $8,800 resistance.

If the price is able to do this, the trend is still valid and the macrostructure with higher lows is also still in place.

For significant bullish perspectives, the bulls need to reclaim $8,800 and preferably $9,400 to be able to look stronger. If the price starts to “grind” upwards to $8,800 without any volume, this would look more like a bearish retest rather than a new trend upwards.

Arguments can be made that the RSI indicator (Relative Strength Index) combined with the crypto Fear & Greed Index shows that the market is overwhelmed with fear and ready to press the sell button. A slight bounce upwards could trigger FOMO of getting back in the market and could generate volume to push the price above the resistance levels at $8,800 and $9,400.

Still bullish until $6K

The overall bullish market structure is still in place, even if the market moves back towards $6,000. That would provide a higher low on higher timeframes and could indicate an upwards trend (macro view).

Would that mean that the market can’t see further downwards movements short term?

That’s possible. However, the halving event is about 230 days away in May 2020, which historically provides a bullish rally around the event.

Aside from that, if the current price action is providing a “beartrap” and the market needs to bounce quickly to generate the FOMO of investors waiting to buy back in. If that doesn’t happen, some lower levels could be tested before a short term reversal.

Notably, 75% of the time Bitcoin price drops before the futures expiry date and this expiration date is Friday, Sept. 26. Adding to this, a new monthly candle is coming up in a matter of days. Both of these events could provide volatility and surprises like Bitcoin always does.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

BTC/USD Daily Chart. Source: Tradingview

BTC/USD Daily Chart. Source: Tradingview