Binance Helps UK Police to Stop $51 Million Phishing Fraud

Binance claims to have assisted British prosecutors in an investigation of an online fraud that resulted in over $51 million losses by victims.

Criminal is now jailed

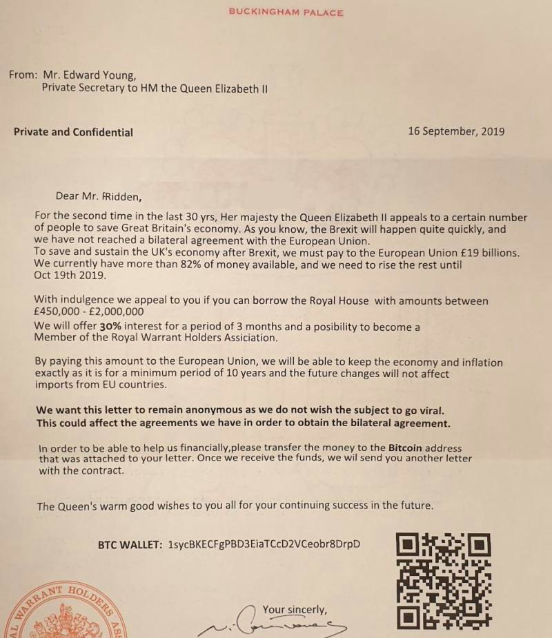

On Sept. 26, Binance’s chief compliance officer Samuel Lim published a blog post saying that the exchange was working with the Cyber Crime Unit of the United Kingdom’s Metropolitan Police Service to investigate into Bulgarian phishing expert Svetoslav Donchev.

As officially reported by the Crown Prosecution Service (CPS), Donchev, 37, was extradited to the U.K. from Bulgaria to face the online scamming fraud charges and pleaded guilty to five offences to receive a nine-year sentence on Sept. 20.

Half a million potential victims

According to the CPS, the criminal created website scripts designed to look just like the real websites of up to 53 U.K.-based legitimate firms to help criminals steal 41.6 million British pounds ($51.3 million). By imitating legal firms, other criminals were able to use his scripts to obtain personal data about clients of those services, which was later reportedly sold on the dark web.

According to estimations, the fraud potentially targeted 500,000 victims.

Staying informed to protect against cybercrimes

In the post, Binance outlined its commitment to ensuring that its community remains secure. Binance further expressed gratitude to British authorities for cooperation in combating cybercrime:

“We are thankful for the UK Metropolitan Police Service, as well as the many other agencies actively working with us, and other industry players, to continue our fight against cybercrime and sustain a healthy, legitimate market.”

Additionally, Lim offered Binance Academy’s Phishing Quiz for Binancians to try out, noting that the best way to protect against cyber criminals is to stay informed about potential security risks and good practices online.

In May 2019, Binance suffered a major hack that allowed hackers to steal 7,000 Bitcoin (BTC) worth around $40 million at the time of the hack. As reported by Binance, hackers deployed a range of tactics including phishing and viruses to obtain a big number of 2FA codes and API keys through the hack.