Blockchains produce huge amounts of data and it seemed that only data scientists and blockchain research firms like Chainalysis and CipherTrace were making use of it. Recently, crypto investors like Willy Woo and Philip Swift have begun to incorporate on-chain data into their rigorous Bitcoin analyses and the results have been astounding.

Despite these efforts, on-chain data remains something of an enigma amongst crypto investors. To clear up the confusion, Cointelegraph decided to sit down with Rafael Schultze-Kraft, the co-founder of on-chain market intelligence platform Glassnode.

Cointelegraph: Let’s start with having you tell us a little about yourself and what you do.

Rafael Schultze-Kraft: I have an academic background in computational neuroscience, programming, machine learning, artificial intelligence and data analysis. Working for several startups in Berlin over the past six years, I’ve gained substantial industry experience applying data science and machine learning to a large variety of real-world problems using data from vastly different domains.

I founded glassnode with my partners and for me it represents the perfect fusion between my passion for data with blockchain and digital assets — probably the most exciting domain to be working on today.

While I am a co-founder and CTO, I make an effort to set time aside to conduct a fair share of data science and analysis as I find getting my hands dirty and engaging with data is the most exciting part of the job.

CT: What is Glassnode’s mission?

RSK: We are the go-to hub for all things on-chain and our purpose is to serve as the primary gateway to on-chain data. We provide advanced insights, market intelligence, tools, and data which are required for investors to freely make sense of all the data which is generated on blockchains.

Our datasets are extremely useful for investors looking for indicators and signals. Furthermore, researchers looking to observe and analyse adoption rates and long-term valuations will find on-chain analytics indispensable.

We seek to increase transparency on what various actors are doing in the field, and on-chain analysis allows one to keep an eye on how they are interacting within the network. One of the big problems we’ve seen in crypto is that exchanges report false volume and conduct wash trading within their order books.

Meanwhile, investors have an extremely limited view of what is really happening within most crypto and blockchain-oriented organizations. On-chain activity paints a completely different picture of what is truly happening and this data is extremely valuable to investors and researchers.

CT: In your opinion, why is it important for investors to study on-chain analytics?

RSK: I think that the most crucial aspect about on-chain is that it is something that has never existed before in finance: a public ledger, transparently unfolding all transactional and economic activity. It would be crazy as an investor not to carefully look at and study this data!

Many investors are using methods and data that they know well from the traditional finance markets and applying them to the digital assets space. Introducing the value of on-chain data in this space, contextualising, and making this data easily accessible and digestible, is a great part of what glassnode is about.

Furthermore, we must remember that there is not just ‘one blockchain,’ there are many different protocols and the interpretation of data across these systems is not a uniform process.

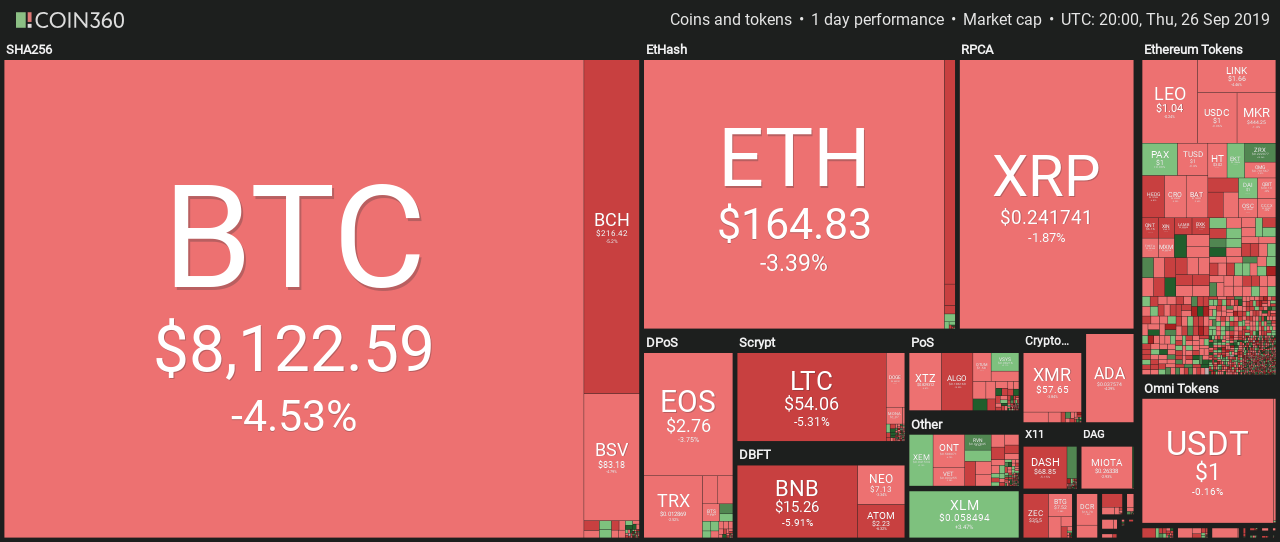

CT: Last week Placeholder partner Chris Burniske said:

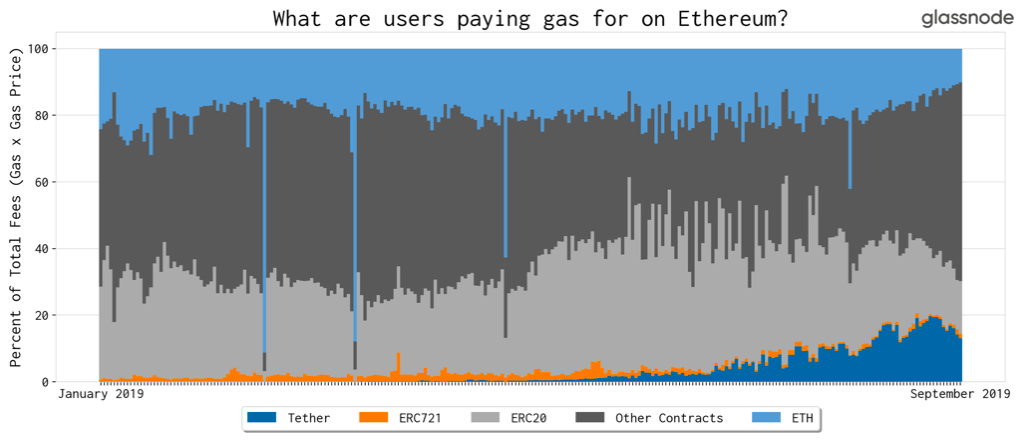

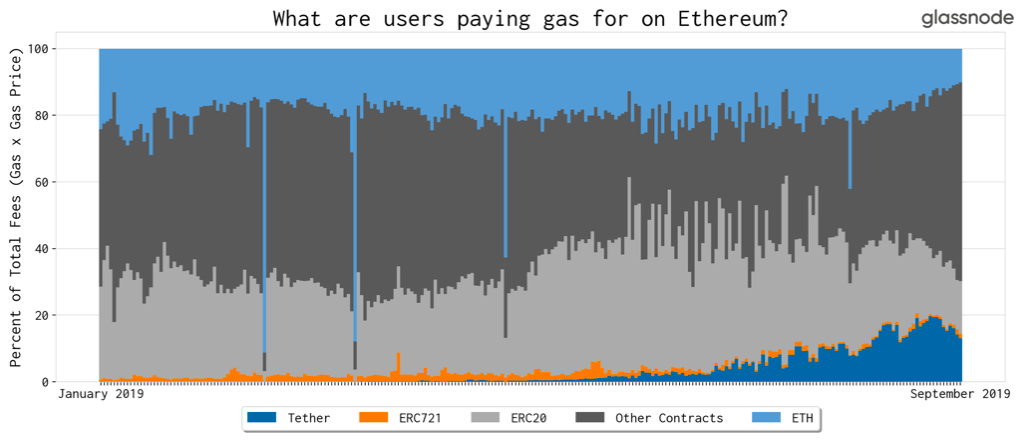

“The narrative that ‘it’s just Tether’ driving Ethereum adoption is not based in fact. Tether accounts for 20% or less of Ethereum’s gas use. ETH‘s uses are heterogenous & robust; people are just now realizing how oversold it was.”

CT: Given that you posted a Glassnode chart showing otherwise, what is your take on whether or not Tether (USDT) is driving the demand within the ETH network?

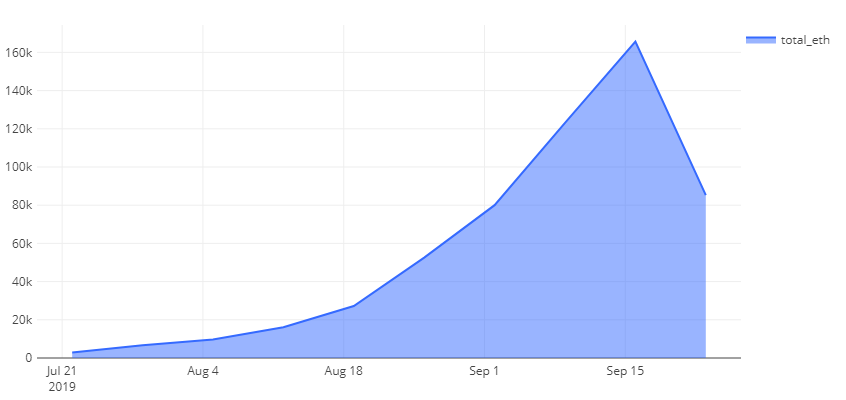

Entities paying gas on Ethereum. Souce: Glassnode

RSK: In my opinion, it’s too early to say that Tether is driving Ethereum adoption. A close look at the chart does show that Tether is driving demand as of late, but it is too early to determine if this trend is sustainable. If you check the chart closely, you’ll notice that demand peaked and then goes down.

Furthermore, when we talk about adoption, I don’t think it is fair to discuss the phenomena purely from the standpoint of Tether activity. The graph also shows a very large portion of transactions related to complex smart contracts that interact with each other.

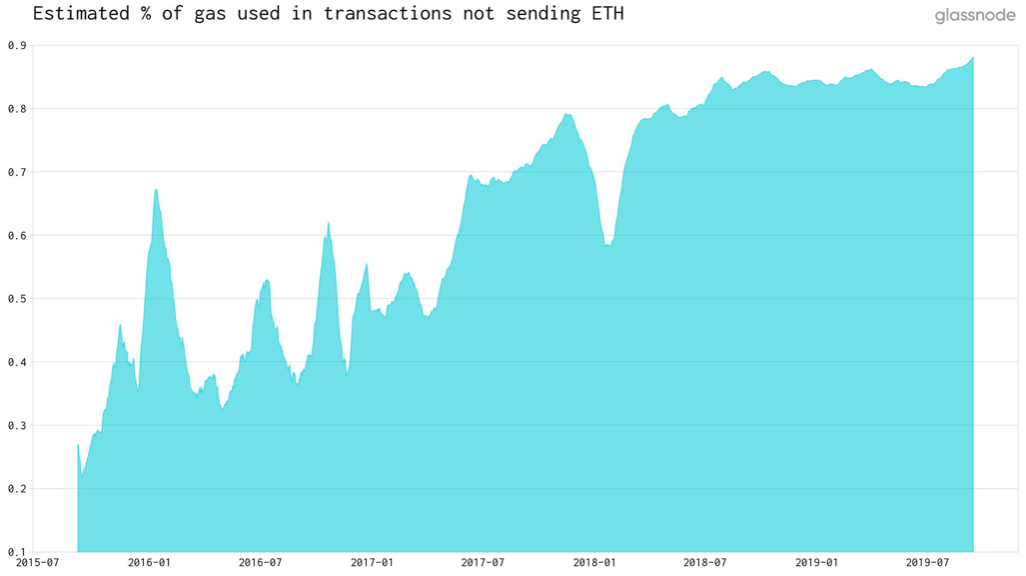

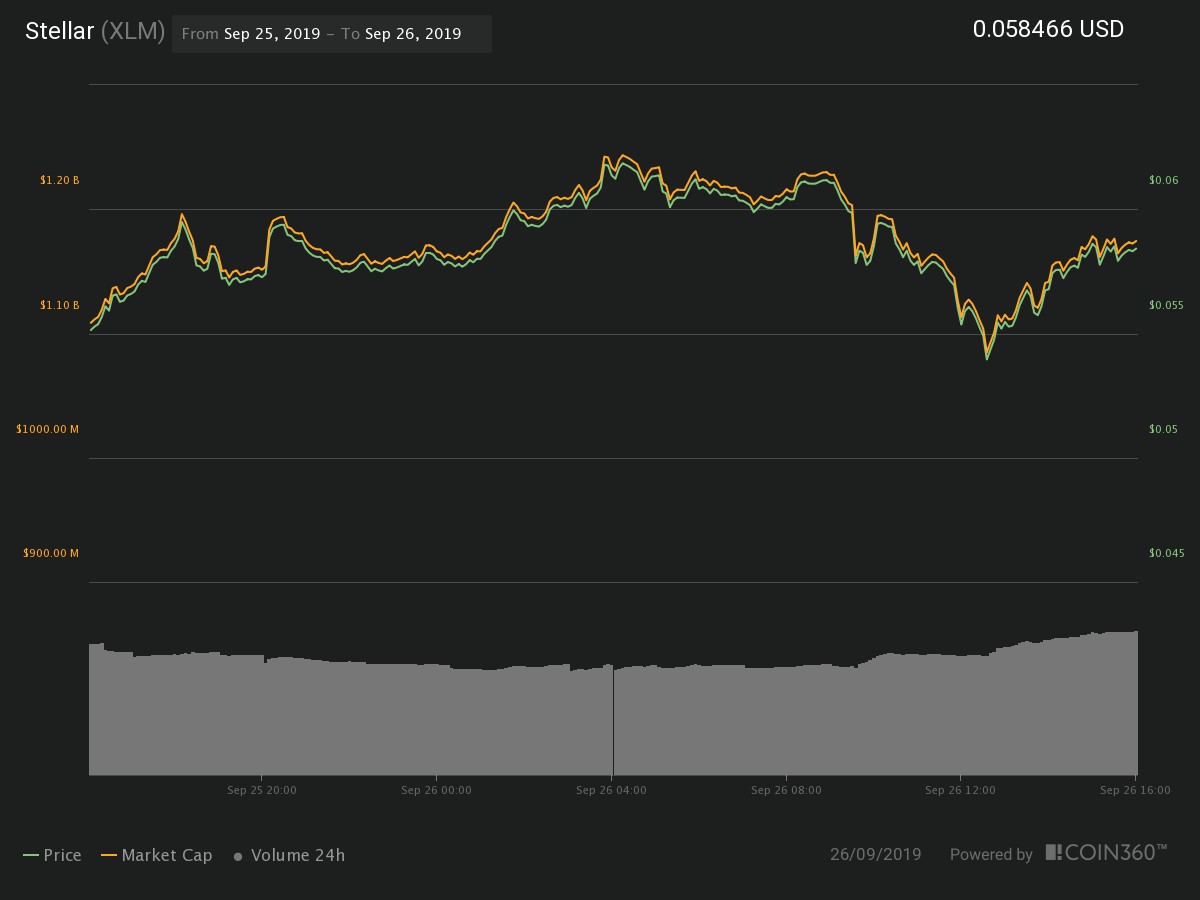

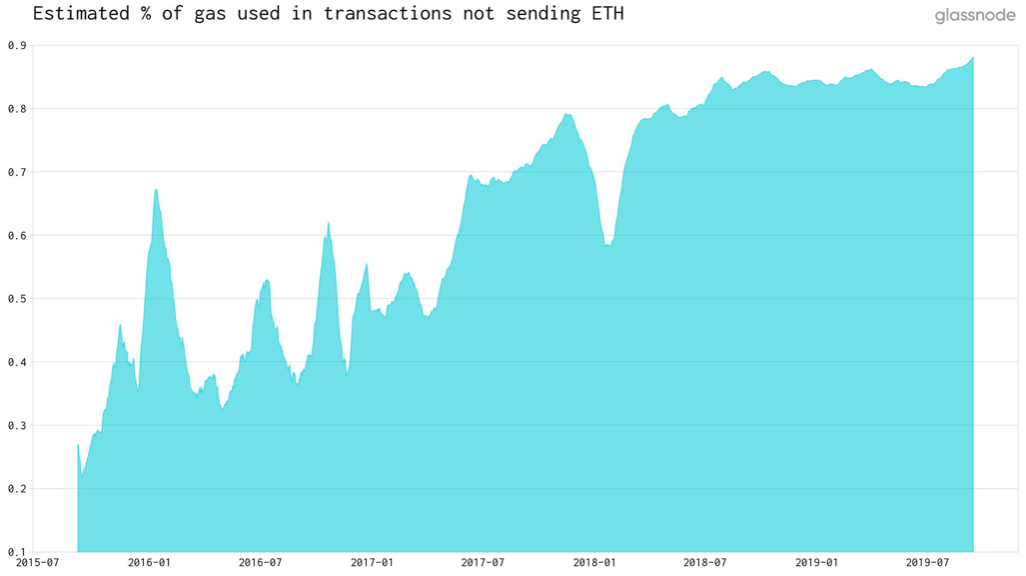

% of gas used in txs not sending ETH. Source: Glassnode

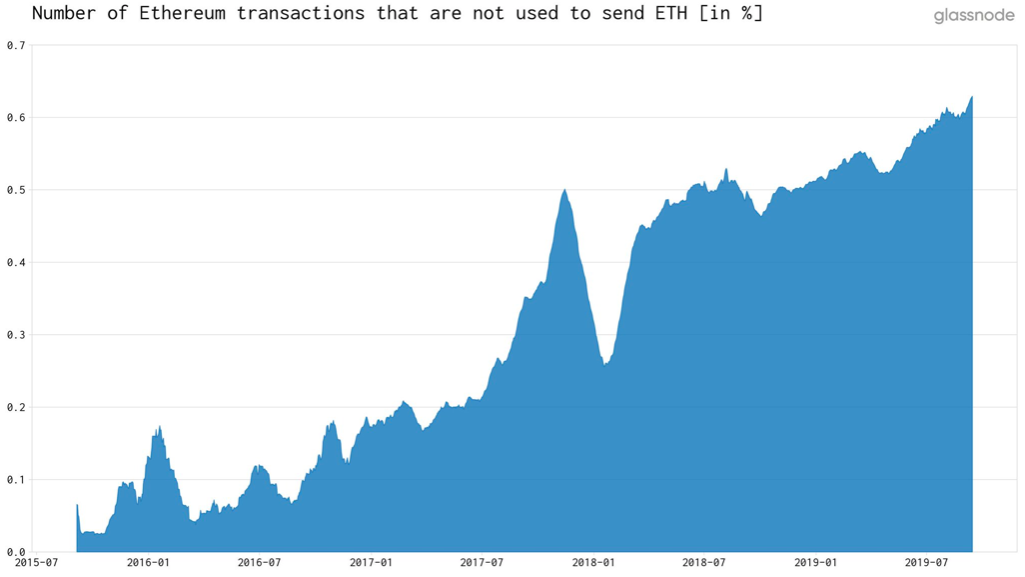

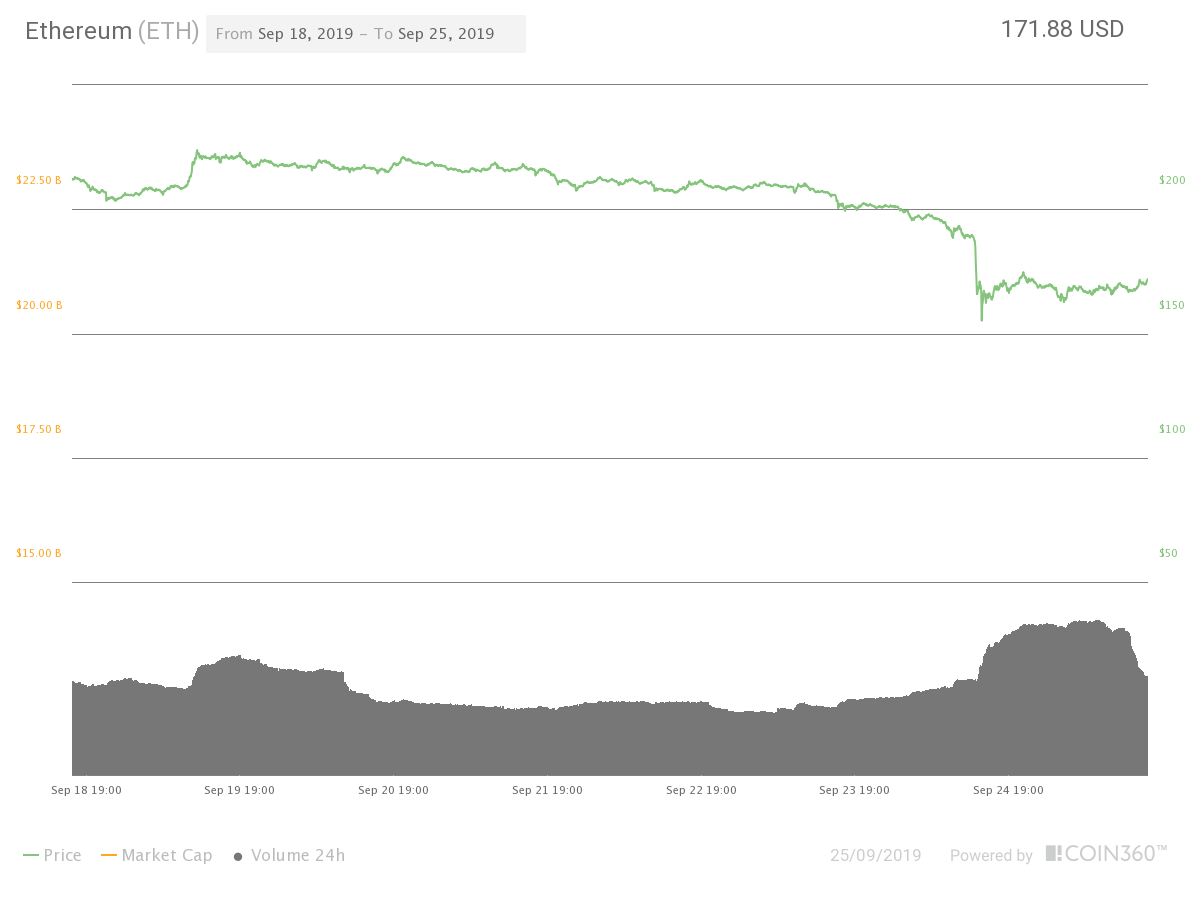

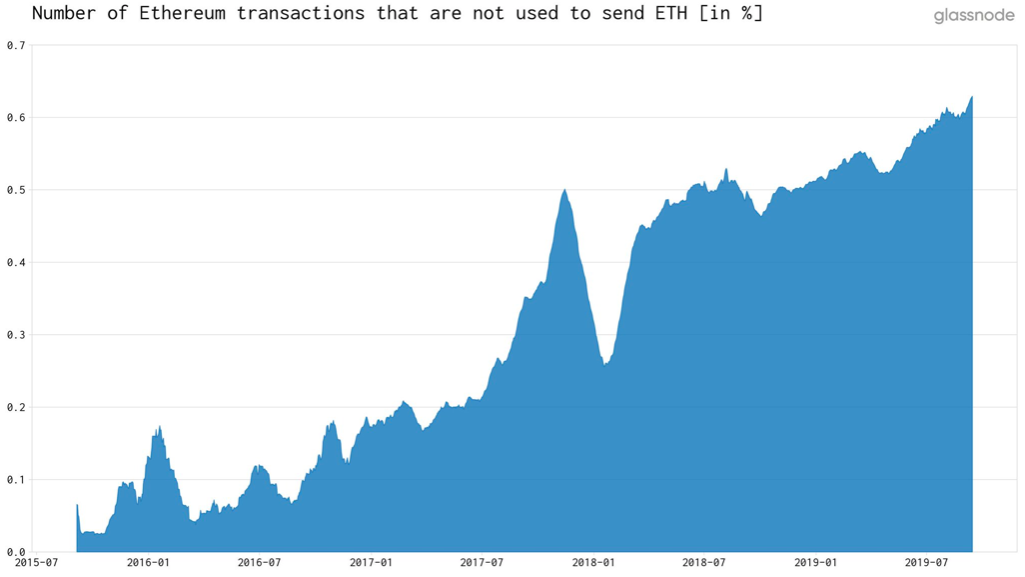

Number of Ethereum txs not used to send ETH. Source: Glassnode

Therefore, it’s too extreme to claim that Tether is driving adoption. What is clear is that currently Tether is driving demand within the Ethereum network as nearly 20% of all network fees were connected to Tether transferring USDT.

CT: So can we infer that we will see consistent, steady or even peak demand for Ethereum in the future?

RSK: It’s too early to say, the only thing we can objectively state is that there has been a huge increase in demand for Ethereum Gas. It went from 1% in June 2019 to more than 25% in a short period of time. Let’s observe how this evolves — Tether will not be the (sole) factor for Ethereum demand in the future.

CT: Does the surge of Tether transactions and growth of the decentralized finance (DeFi) sector mean that increased demand and higher gas fees will lead to price stability and additional growth of Ether’s price?

RSK: Tether is a token that is pegged to the dollar so people can trade easier without going back into fiat. It’s clear that the token is heavily used and that its primary utility is for trading cryptocurrency. It can be traded using automatic robot like bitqt. Read about bitqt here. Therefore, I would say that it probably has some influence on price.

DeFi platforms are a completely different animal. These are complex, self-sustaining decentralised systems that provide a venue for the exchange of value, goods and services.

In theory and practice, they truly represent the ideal interaction one envisions Ethereum facilitating and as these platforms continue to grow it is entirely possible that the digital asset supporting these ecosystems will stabilize and potentially even increase in value.

CT: What would you say are the core concepts one needs to grasp in order to understand on-chain analytics?

RSK: I think people need to have a very basic understanding of core on-chain concepts such as transactions and addresses, and the differences between UTXO (unspent transaction output) and account-based systems like Ethereum.

From an investor’s perspective I would start by looking at core metrics such as transaction volume and number of active addresses, and then reading about and understanding the more advanced and established indicators metrics. In my opinion these are SOPR, realised capitalization, MVRV, HODL waves, coin days destroyed, and liveliness — to name a few.

CT: Is there a way to automate on-chain analysis for robo investment platforms or do investors just need to add these steps to their routine toolkit for conducting asset analysis?

RSK: Yes, on-chain data can absolutely be used for algorithmic trading. This data can be fed into automated systems along with any other data source traders use. And the added value in doing so, we believe, is immense. That is why we offer our on-chain metrics through a unified API, so anyone can easily integrate with their algorithmic trading platforms.

On the other hand, on-chain data has shown to be very useful for discretionary trading as well. On-chain indicators can be used to better understand economic behaviour in these networks, as well as analyse and predict market cycle tops and bottoms.

CT: What else do you want to tell me? Are there any additional hot topics, statements or opinions of importance that you think the world should know?

RSK: I want to emphasize that we (as in those interested in blockchain and cryptocurrency) are still early in this space and I think that every person that is investing in digital assets should begin to consider on-chain analysis as part of their analytical regime.

Analysis of data from blockchains is revolutionary. It is very different from the old world traditional style of asset investing.

This data is fundamentally important for crypto investors, yet the majority of investors do not understand the value it unlocks. It’s possible that investors unknowingly (subconsciously) write off the value of on-chain value as upon first glance it appears difficult to interpret due to the blockchain specific terminology and unconventional application of analytical methods.

Sometimes you just don’t realize how valuable something is until its demonstrated to you.

As I said earlier, many crypto investors are simply applying methods from the old world of investing (indicators and conventional trading ideology) to a totally new asset class which is behaviorally and technically different from traditional assets.