Ether Price Drop Shakes DAI Stablecoin Peg, Two Collateral Contracts Closed

The recent Ether (ETH) price drop showed the reliability and weaknesses of the decentralized stablecoin built by MakerDAO, Dai (DAI), and the decentralized finance (DeFi) ecosystem built on top of it.

A decentralized stablecoin

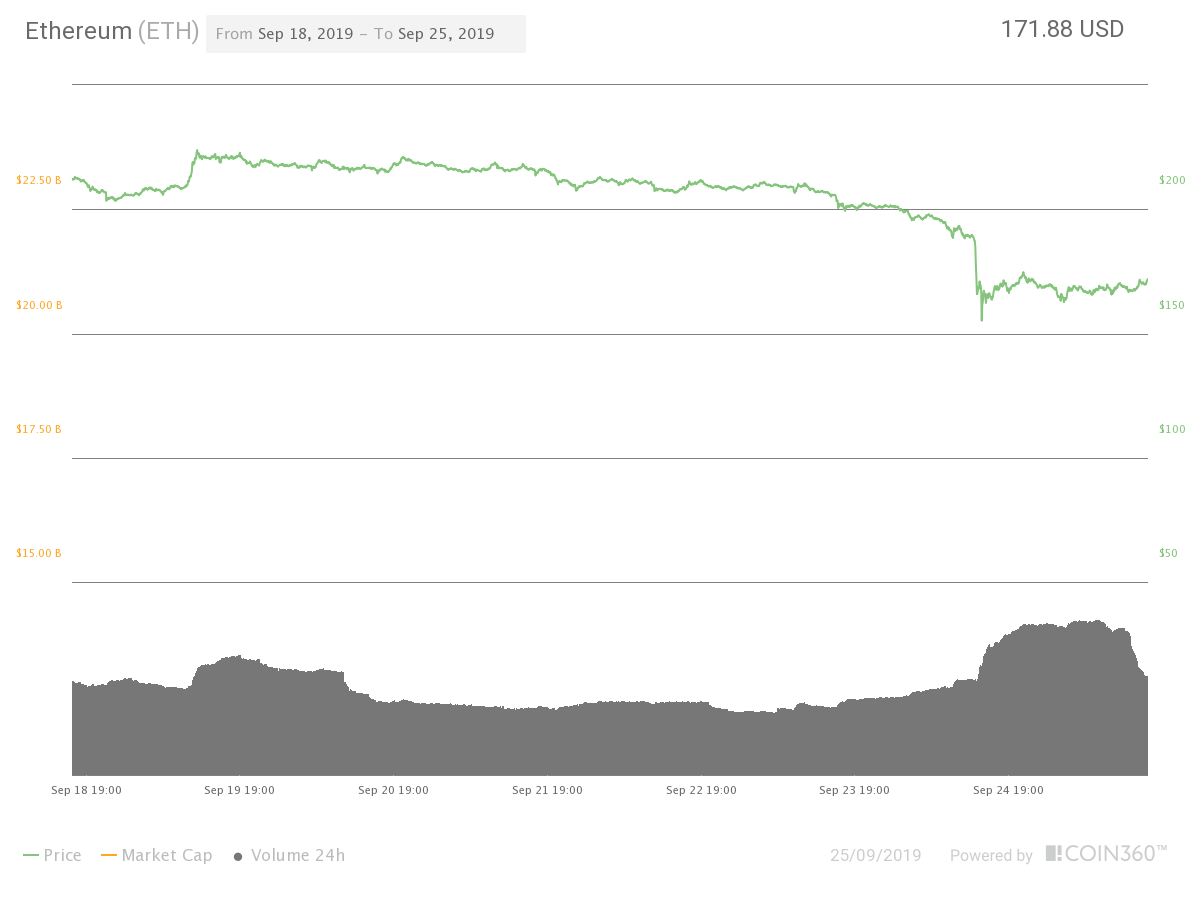

Ethereum-collateralized decentralized stablecoin DAI managed to maintain its peg to the United States dollar as Ether lost over 18% of its value in under two hours, falling from $190 to $155 yesterday. As of press time, Ethereum holds a price of about $171.

Ethereum seven-day price chart. Source: Coin360

The impact of higher transaction fees

DeFi protocol management service DeFi Saver announced in a tweet on Sept. 24 that, because of heavy congestion on the Ethereum network, the system “struggled to execute all needed Collateralized Debt Position (CDP) ratio adjustments in time.” A CDP is a type of loan administered by a smart contract central to the functioning of the DAI stablecoin.

While MakerDAO plans to add support for other assets, so far only Ether is accepted as collateral for opening CDPs. CDPs facilitate the creation of Dai against collateral which is held until the DAI is returned. As DeFi Saver explained in a separate tweet, “MakerDAO has a mechanism in place that automatically liquidates CDPs once their collateralization ratio has dropped below 150%.”

The company offers an independent service preventing the automatic CDP liquidation built on top of MakerDAO’s ecosystem. However, the company admits that — because of network congestion and transaction fees — the system “failed to protect 2 monitored CDPs, which have been liquidated in the process.” Still, the firm announced that it intends to compensate the two users affected by the malfunction:

“Although our automated protection is still in beta, our team is disappointed to have let some of our users down and we are willing to recuperate the losses suffered. […] We ask the owners of these two CDPs to please reach out.”

An optimist perspective

On the other hand, the company also noted that “20 unique CDPs have been automatically protected by the system during this recent crash.” DeFi Saver also notes that it adjusted the system to the current transaction fees and that automation is working properly.

The author of “Mastering Bitcoin,” Andreas Antonopoulos, pointed out the development on Twitter. When another user suggested that the situation is a demonstration that the DeFi ecosystem does not work properly, Antonopoulos responded:

“Not really. It seems like DAI maintained the price parity, the CDP protection contracts worked in all but two cases. This was a good test and things worked pretty well”

As Cointelegraph reported in June, throughout May 2019, United Kingdom-based nonprofit organization Oxfam International executed a month-long trial that saw MakerDAO’s DAI stablecoin distributed as a means of exchange among citizens of Vanuatu.

Leave a Reply

Want to join the discussion?Feel free to contribute!