Bitcoin (BTC) has a unique advantage: self custody, which the traditional financial system cannot compete with. It is important that the Bitcoin ecosystem maximizes this competitive advantage in order to compete with the legacy system.

Custodial solutions are important for financial markets, whether traditional or innovative, and have been historically limited for Bitcoin. But why do institutional investors need custodial services, and what are the unique challenges of Bitcoin custody?

Why institutional investors need custodial services

There are two main reasons why institutional investors need custodial services: reducing risk and regulatory compliance.

By separating the entity that stores assets from the entity that manages assets, financial institutions can specialize in what they are best at. This separation also reduces the risk that one employee can run off with all the money. Usually, custodians are long-standing financial institutions with a lot of reputational risk that prevents them from acting against their clients’ interests.

In terms of regulations, the dominant regulatory bodies around the world — the United States Securities and Exchange Commission (SEC), the United Kingdom’s Financial Conduct Authority, the Monetary Authority of Singapore, etc. — all require institutional investors to keep customer funds with regulated custodians. Typically, regulated custodians are broker-deals or banks.

Unique challenges of Bitcoin custody

Providing custody for traditional financial instruments is already challenging in its own right, and Bitcoin and other cryptocurrencies present an exceedingly complex task. Both retail investors and professionals face unique challenges in safely storing their Bitcoin.

Challenges in Bitcoin custody

First off, cryptocurrencies are bearer assets, meaning that whoever has control of the asset, owns the asset. In other words, if you lose your Bitcoin or someone steals it, there are no options to get the money back. This is unlike a bank account or credit card, with which a bank can simply reverse a transaction.

Most retail investors store their Bitcoin on exchanges or hot wallets that have a history of being hacked. This is not a suitable option for professional investors. Some of the smarter retail investors use hardware wallets that enable users’ Bitcoin private keys to be stored offline, which is significantly safer than an exchange.

However, from an institutional investor perspective, a single USB hardware device is still too risky for managing client funds. What if an employee walks off with the hardware wallet and all the funds? Instead, the investor should seperate power so that no individual has the ability to go rogue.

The crypto custody industry is growing quickly, but it is still young and inexperienced compared to traditional finance. In order for big financial institutions to consider investing in Bitcoin, the custody side needs to be addressed. On top of custody, investors also need insurance products that protect Bitcoin and other cryptocurrencies from theft.

Institutional custody solutions

Professional investors need compliant cold storage and insurance from brand-name companies with a strong reputation. There are many native crypto solutions, but they don’t satisfy the biggest financial players.

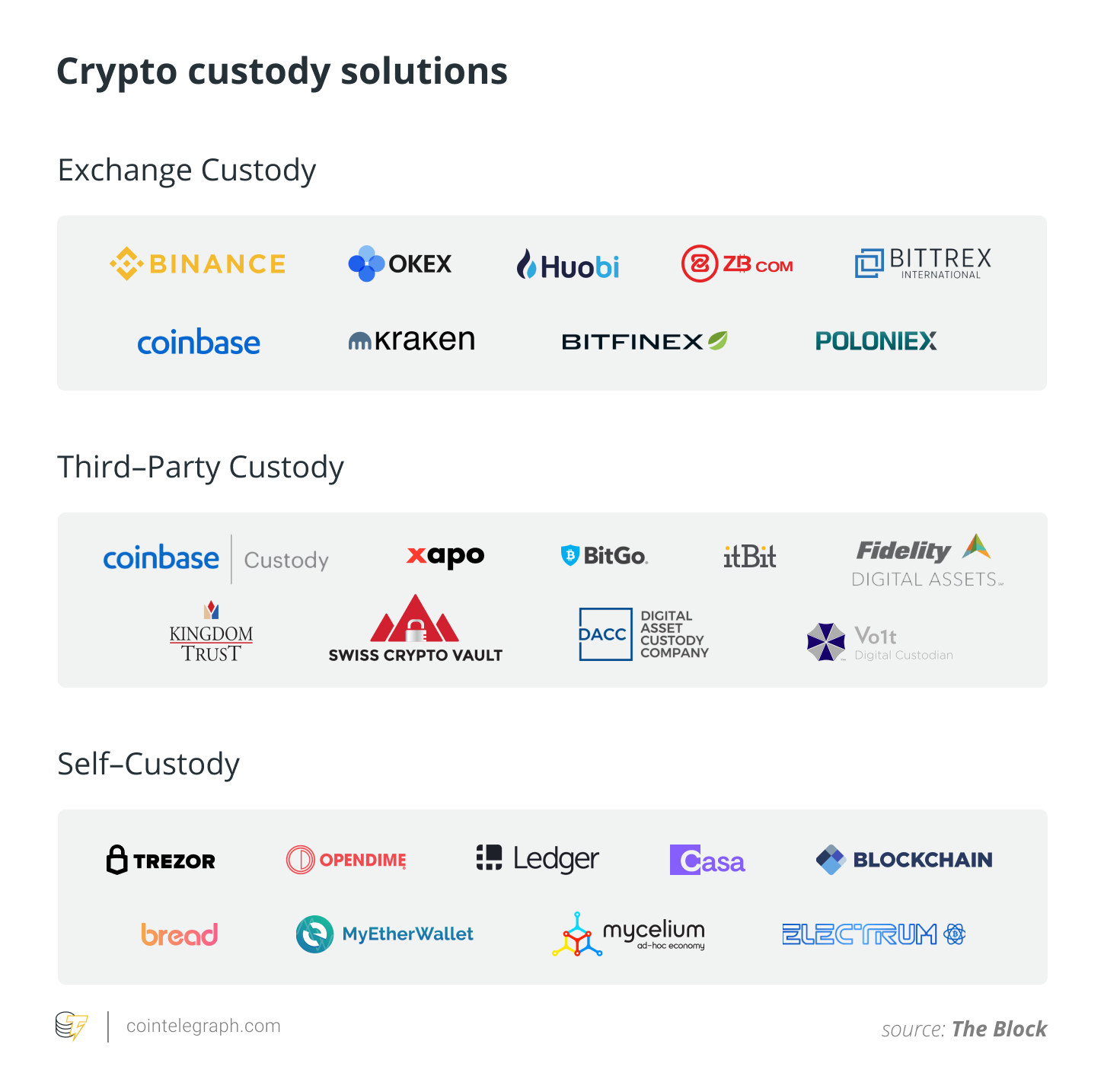

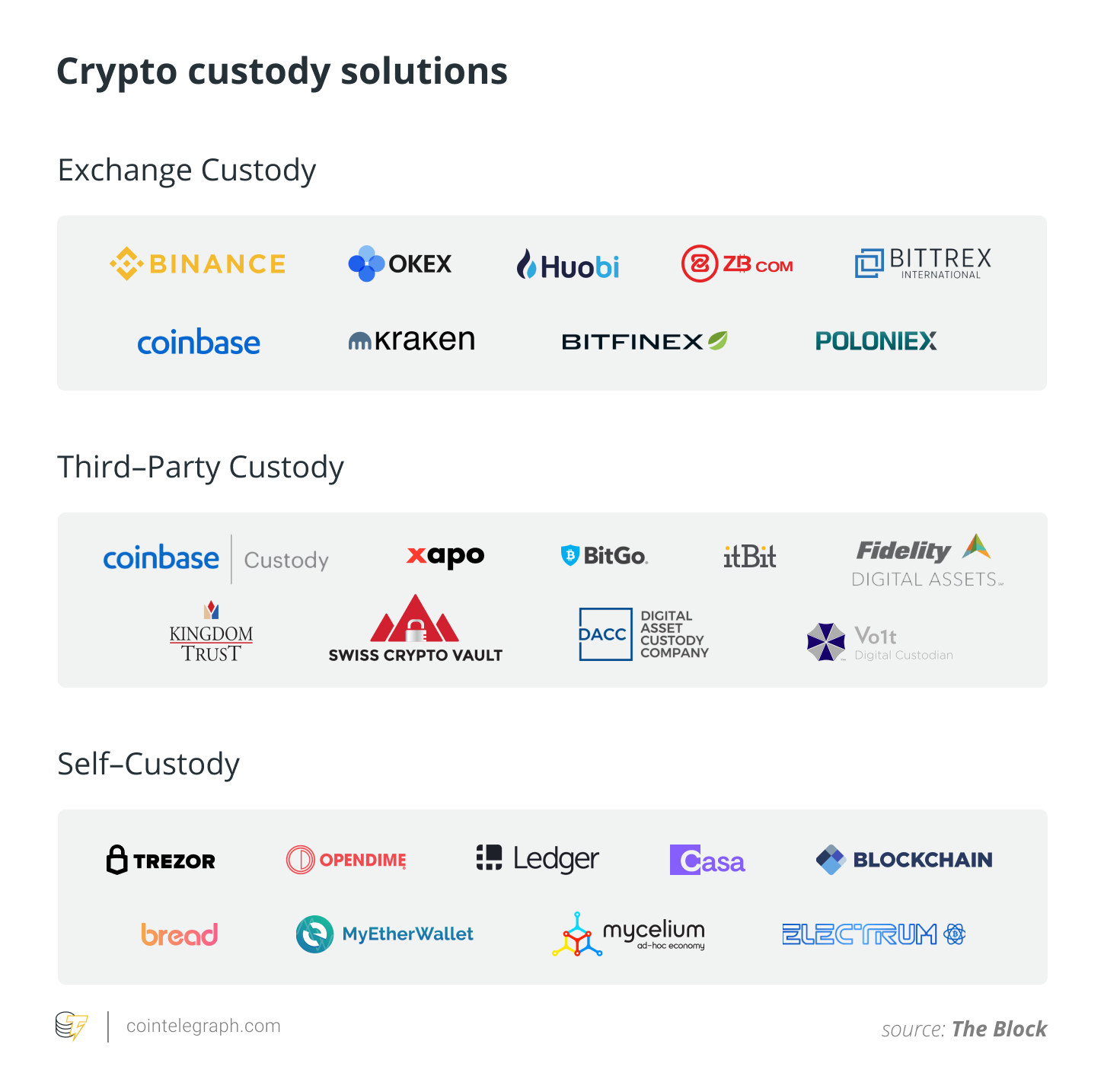

Native custody options for crypto include Coinbase Custody, Xapo, Onchain Custodian and many more listed on the graphic above. These services have been successful so far, although the scope is limited, as smaller, progressive capital allocators leverage these services. However, most large institutions are still on the sidelines.

Thankfully, marquee financial institutions are stepping into the custody space, such as Fidelity, which released its institutional custody solution in mid-2019. It’s too early to predict how this will impact the market, although a traditional financial institution custodying Bitcoin is a very promising sign.

Related: Insured Crypto Custody Services: Key to Institutional Investment Growth?

Bitcoin ETFs?

One hot topic in the crypto space is Bitcoin exchange-traded funds (ETFs). The assumption is that ETFs are an easier way to give investors exposure to Bitcoin. For example, if a Bitcoin ETF existed, anyone with an e-Trade, Fidelity or any other broker could easily purchase Bitcoin.

So far, the U.S. has not approved a Bitcoin ETF, and one reason being that there aren’t any third-party custody solutions that the SEC trusts. However, Fidelity and the incoming wave of institutional custody could help get an ETF approved in the future.

Related: A Brief History of the SEC’s Reviews of Bitcoin ETF Proposals

The reality is that the crypto space is still a fledgling industry with many hurdles to overcome. Thankfully, an increasing number of people are leaving traditional finance to come build a parallel financial system with Bitcoin. A mature fiat onramp ecosystem with custody and insurance allows family offices and hedge funds the peace of mind and convenience to allocate some capital to Bitcoin. Will traditional finance acquire Bitcoin in a meaningful way? The truth has yet to be seen.

Personal custody: Be your own bank

Besides the institutional custody space, retail investors are also looking for improved ways to manage their Bitcoin holdings securely. The promise of being your own bank is very alluring. However, it requires taking on significant personal responsibility.

In the early days, storing your Bitcoin private keys was quite challenging and only available to technically minded users. However, the custody options for retail investors have improved dramatically in recent years.

There are a range of solutions ranging from hardcore cypherpunk storage to fully trusted “crypto banks” like Coinbase. It’s important that users are acquainted with the risks as well as the technical sophistication of their chosen custodian.

A node in every home

A popular narrative emerging in the Bitcoin space is the idea that every house will have its own Bitcoin node that trusted family and friends can reference. Each user would then have their own dedicated hardware wallet(s) to manage their private keys. While this sounds complicated, it simply means setting up a second hardware device next to the Wi-Fi router.

This setup would enable users to fully validate all Bitcoin transactions while minimizing the technical challenges. In the future, all users could be fully self-sovereign with their finances if they choose to.

Multi-signature solutions

After setting up a home node, the next step to personal custody is setting up a multisignature account. This is not a requirement, but it dramatically increases security.

Tech-savvy users can set up their own multisignature with tools like Glacier Protocol. However, most users will likely use a Bitcoin service that makes a multisig easier to use. For example, Casa has created both a home node as well as a multisignature solution called Keymaster, and are currently offering a free two-of-three multisig tool for users looking to start playing around with more advanced security models. Another option is Unchained Capital’s vault solution. Unchained is a semi-trusted Bitcoin bank that offers self-sovereign custody software as well as financial services such as lending.

As a cryptocurrency investor, it’s important to identify your own security needs and pick the solution that best meets them.

While custody may not be a fun topic to discuss, it is a vital part of a successful financial system. Thankfully, we’re seeing an explosion of new custody services being offered to satisfy both retail and institutional investors.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Rohan Barde is a research and innovation manager at Blockchain Zoo. He is a tech-passionate professional with more than five years of experience. A business administration background gave him a solid understanding of what businesses need. Currently, he is exploring how needs of modern business can be met with applications of machine learning, big data, artificial intelligence and blockchain technology.