A couple of years back, the term “exit scam” became synonymous with the crypto industry. This was at a time when the market (at large) was replete with a number of cash grab ventures that looked great on paper but had little to no substantive value to back them up.

In its most basic sense, an exit scam can be thought of as a fraudulent scheme wherein the organizers of an initial coin offering (ICO) or a similar fundraising avenue disappear with their investors’ funds after acquiring a sizeable sum of money.

In this regard, during November 2017 — a time when the crypto market was at its apex — the owners of an escrow-related crypto startup called Confido vanished overnight after acquiring a sizeable sum of $175,000 from their backers. As a result, the market capitalization of Confido’s associated crypto offering (under the ticker CFD) dropped from $6 million to a paltry $70,000 within the span of just seven days.

Related: What Are the Biggest Alleged Crypto Heists and How Much Was Stolen?

Other notable cases include Bitconnect and OneCoin, with the former probably being the most famous altcoin scam of all time. The aforementioned ploys each cost gullible investors in excess of $3 billion — with Bitconnect’s native token offering, BCC, even becoming a top-10 crypto in terms of total market capitalization.

Hence, in order to gain a better understanding of exit scams and how best to steer clear of them, Cointelegraph reached out to Ben Samocha, the founder and CEO of CryptoJungle, a leading Israeli digital platform for how-to guides. According to Samocha:

“You can never know when it’s truly about to happen. For example with BitConnect if I had to bet, I would’ve said they should’ve exit-scammed way before the time they did.”

In regard to how investors can assess when an exit scam is about to go down, Samocha pointed out that it can be extremely useful for all stakeholders to actively pursue information related to the project (such as confirmations of partnerships, licenses, etc.) by following the company’s blockchain wallets as well as their media engagement levels.

For example, if a project’s online media output suddenly starts to drop — or stops a month or two after its inception — this can be taken as a definitive sign that something shady is going on.

Obvious red flags to be wary of

The principle behind an exit scam is quite simple. First, the promoters launch or propose a new crypto platform that is based on a promising concept. Through an ICO, the organizers are then able to acquire a decent sum of money, following which, they proceed to make their getaway — thereby leaving their investors in the lurch.

Along the way, there are usually a number of red flags that investors should keep an eye out for. Here are a few prominent examples:

Shoddy white paper

A lot of exit scams tend to feature white papers that are either under-researched or are of extremely poor quality. For example, they may feature full sections that have been directly copied from other established projects or come laden with a number of spelling mistakes and basic grammatical errors.

Unrealistic profit projections

Another surefire sign that a project is shady is if it makes bold, outlandish claims related to its financial returns. For example, upon its release, Bitconnect promised its core clientele a daily revenue stream of 1% — a figure that would eventually transform one’s initial $1,000 investment into a little over $50 million within a period of just three years.

Related: Exit Scam in Wonderland: Bitconnect’s Tentacles From Texas to Gujarat

At the time, Ethereum co-founder Vitalik Buterin was highly critical of the project and called it a Ponzi scheme — and rightly so, because within a few months time (January 2018, to be exact), BitConnect closed down all of its lending and exchange services, which resulted in the project’s market cap falling from $2.7 billion in December 2017 to around the $17 million mark by the end of March 2018. On the subject, Samocha pointed out:

“Conduct proper due diligence, do not believe unsustainable false promises such as 6%+ profits guaranteed, look for the fundamentals and the proofs: they claim to have a partnership? Ask for transparency, approach the partner and verify it, etc. In addition, take extra care for MLM models that have several layers of profits (meaning, you gain commissions not from the people you recruit, but from their recruits as well).”

Team details

Back in 2017, a number of ICOs were able to raise substantial sums of money from investors, despite the organizers not providing any tangible details regarding the project’s key personnel.

Not only that, a host of established ventures in the past have even resorted to buying likes, tweets and followers across various social media platforms to increase their online credibility. Thus, it is of utmost importance that people carry out their own research in regard to the promoters and backers of a particular ICO that they might be interested in.

No working product

If a crypto project is backed only by a concept and not a working model, it is quite likely that the envisioned final product may never see the light of day. And while it is true that there are some technologies that have been developed from scratch, when it comes to crypto, any groundbreaking idea should ideally come backed by some sort of operational platform at the time of raising funds.

How to best avoid exit scams

It is quite clear by now that most crypto scams are usually centered around an ICO. However, it is worth pointing out that there have been more complex cases in the past — e.g., Bitsane, a scammy venture that was able to operate for a few years before finally being forced to shut down.

To better understand some of the security-related aspects of exit scams, Cointelegraph reached out to Robin Singh, the founder of Koinly — a crypto portfolio tracker and tax calculation platform. Regarding security, he explained:

“As with all investments you really need to do your due diligence when investing in a crypto product or company. Do you understand the product? Can you corroborate the numbers showcased by the promoters from independent sources? Is there any evidence of demand for the product? Is the team behind the product ‘real’? Most scam companies use fake linkedin accounts to avoid accountability so it is always a good idea to validate their existence.”

Additionally, Singh also pointed out the following aspects that he believes can be useful for crypto investors in general:

- Investors should ensure that they are being offered a working and validated product that already has some traction.

- Investors should avoid investing in an idea-only product with a multiyear roadmap.

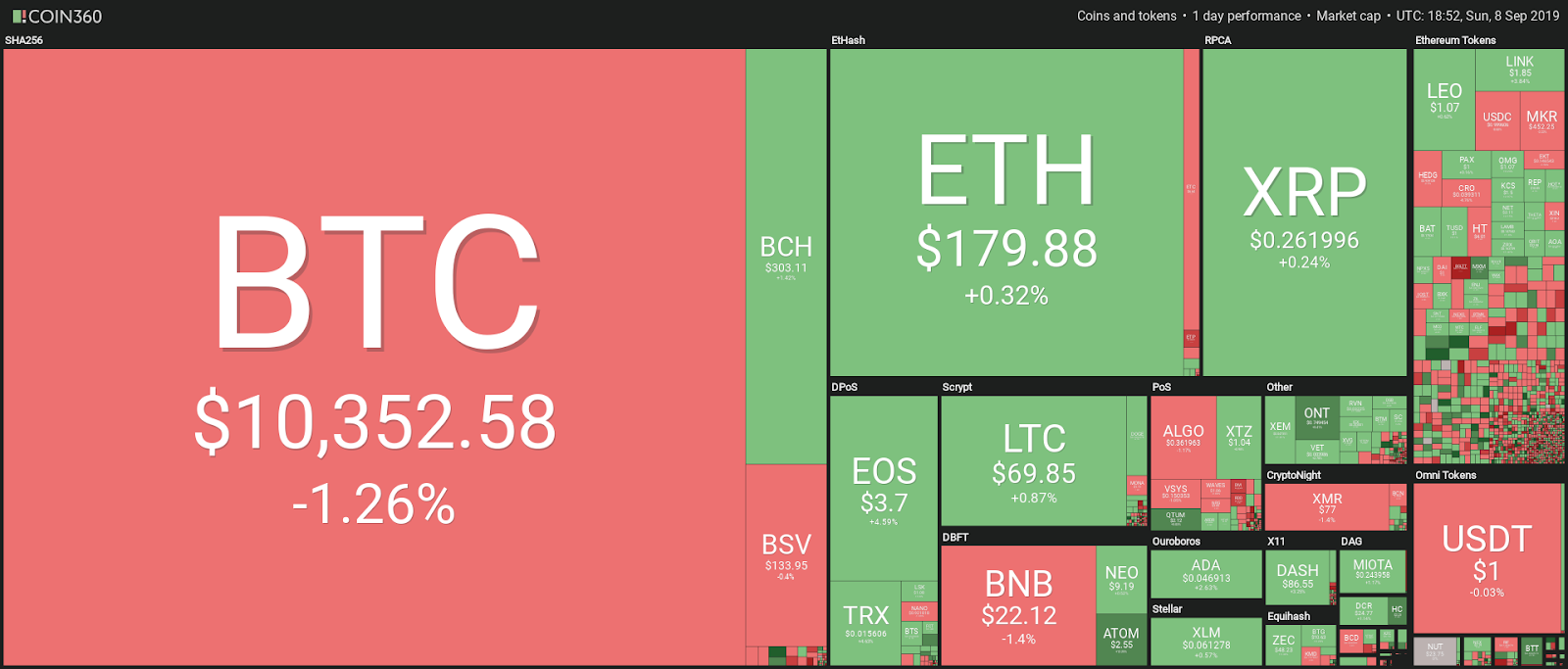

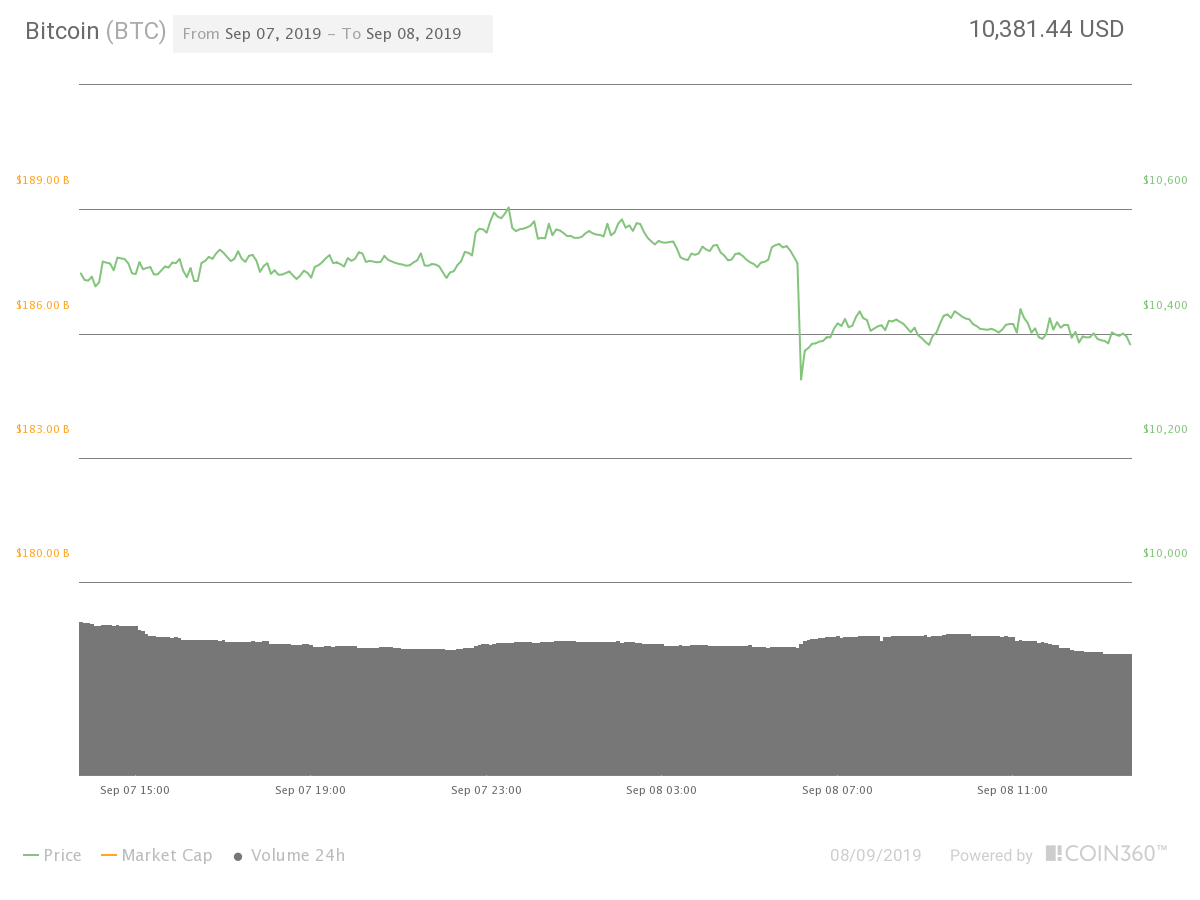

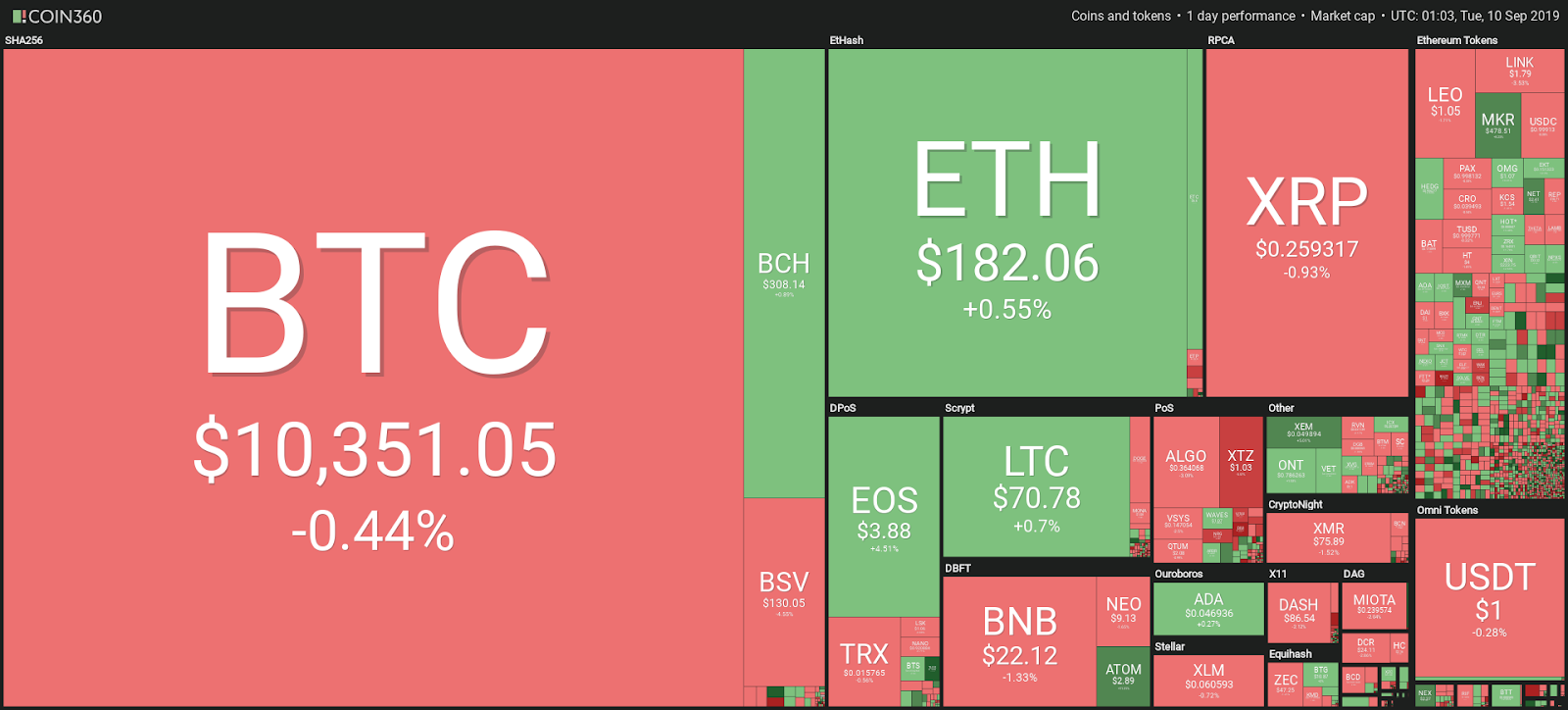

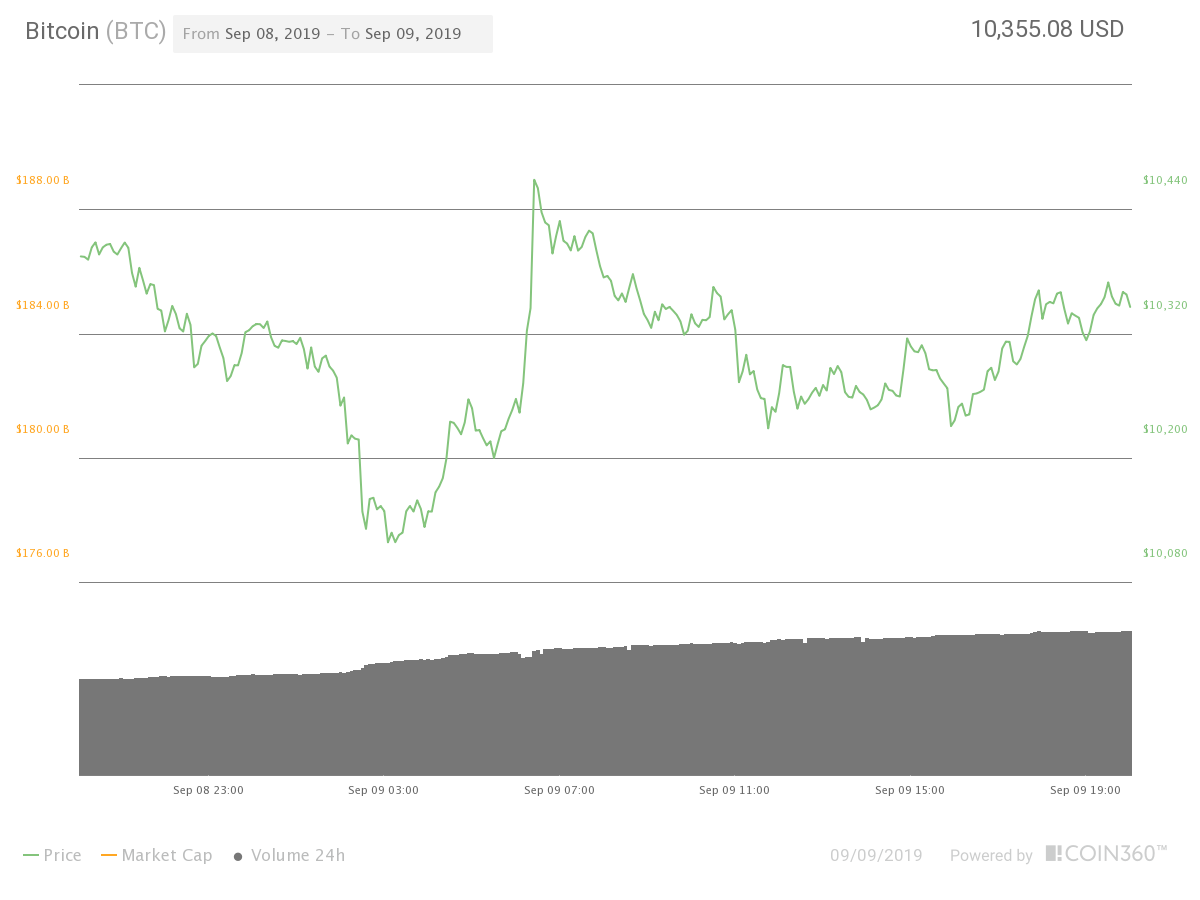

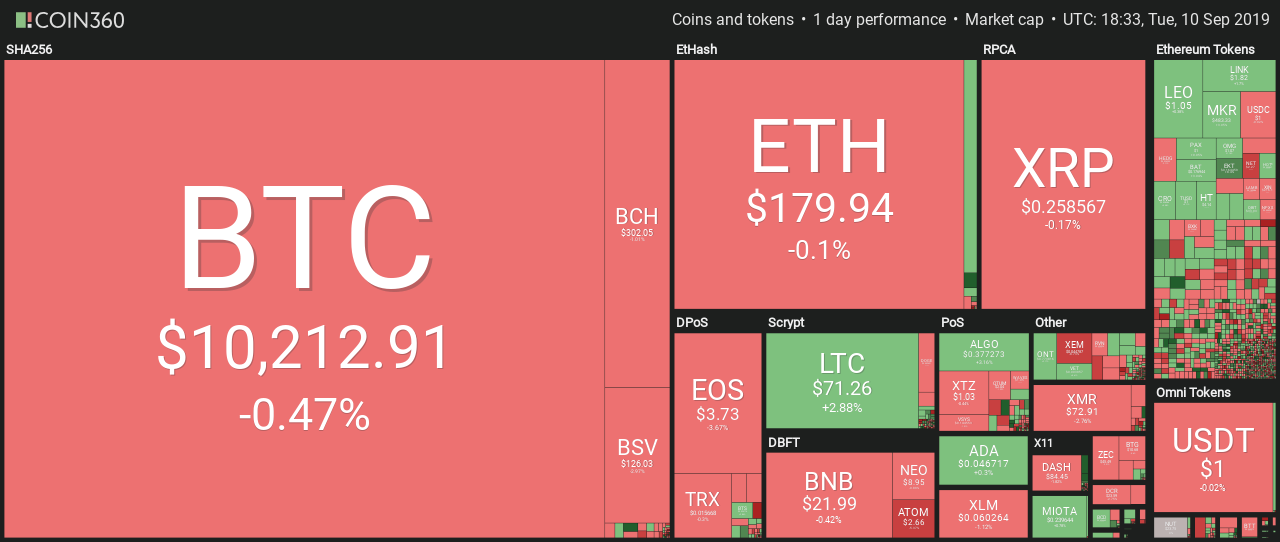

- Investors should keep in mind that, though global investor sentiment usually decreases after an exit scam is revealed, people still seem eager to invest in Bitcoin – evidenced by the price reaching the $10K mark recently.

In a similar vein, Nischal Shetty, CEO and founder of WazirX — India’s largest cryptocurrency exchange — pointed out that the most important thing to remember when investing in a nascent crypto venture is whether its founders have a good track record or not.

Additionally, potential investors should look up a project’s founders on Twitter, LinkedIn (and possibly even Facebook) to verify whether they have been active in the crypto realm for at least a few years. Additionally, on the topic of what to do in case one falls prey to an exit scam, Shetty outlined to Cointelegraph:

“Raising a complaint in your country’s cyber crime division is a good first step. Cyber crime teams can try to trace the location of such scamsters. Most times, if the scamsters are smart then they’ll employ techniques that allow them to be completely anonymous or use a different identity. The best way to curb is to ensure there is enough public information about the founders. Founders with a good social standing will not pull an exit scam and even if they do, it’ll be easy for law enforcement to catch them.”

It is all down to common sense?

It should be made abundantly clear that the safety of financial assets is entirely the responsibility of the individual. Making money via crypto trading or investments requires a lot of due diligence by the investor and it thus is always desirable that investors do their homework before going in big on a particular crypto project.